crypto tax calculator canada

Example of tax calculation. Meet a fictional chap named John who lives in British Columbia.

Https Www Thepirateboys Org Monero Roi Calculator Monero Roi Calculator Business Calculator Crypto Cryptocurrency Exchange Calculator Investing Coding

This is known as a Capital Gains Tax and has to be paid in most countries such as the USA UK Canada etc.

. The best crypto wallets in Canada work a little like bank accounts but for cryptocurrency. Your marginal tax rate is the total of both federal and provincialterritorial taxes on income. After his RRSP contribution and other tax deductions and tax credits he.

So what are the possible issues that new regulations will throw up. Despite being around for only three years it has become a favorite for investors accountants. Standard Deviation Calculator Income Tax Calculator Age Calculator Time Calculator BMI Calculator GPA Calculator Statistics Calculator Fraction Calculator Diabetes Risk Calculator Date Calculator Log Calculator.

John has been contributing to a Wealthsimple RRSP to reduce his taxable income. Koinly can create the most accurate crypto tax reports for you. And what will be its long term and short term impact on the crypto investors and exchanges.

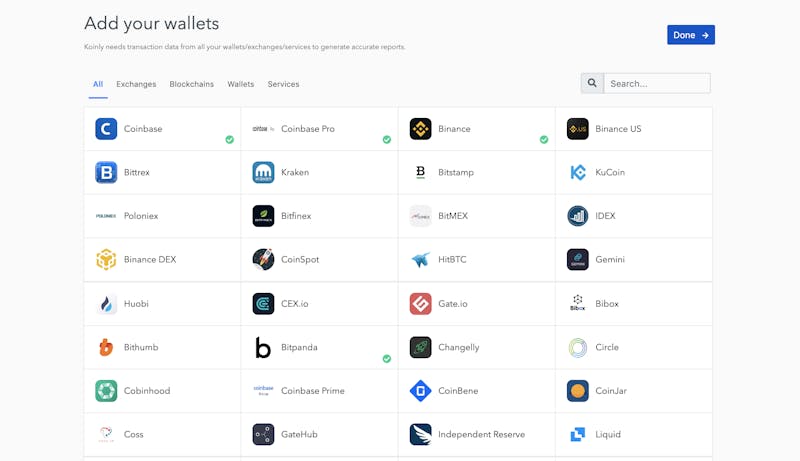

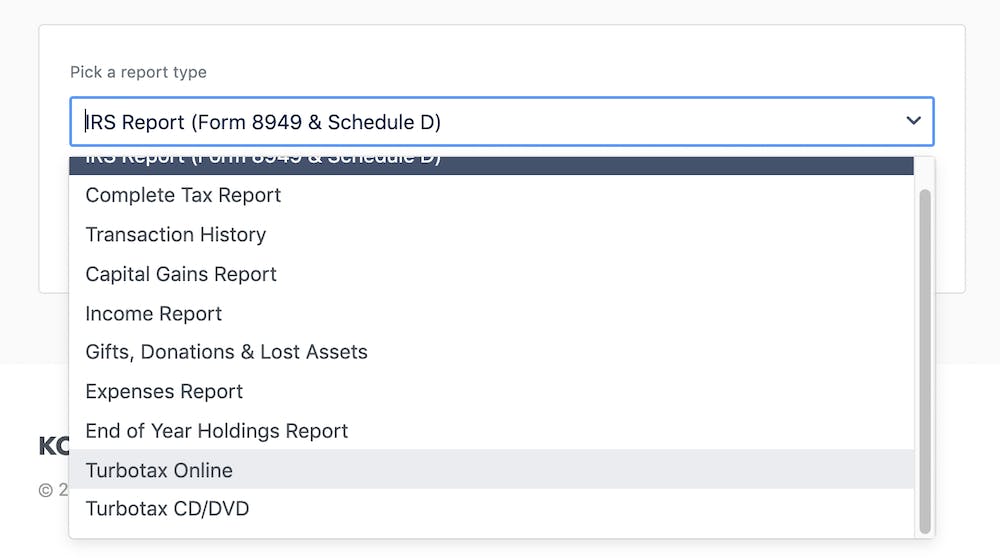

It integrates seamlessly with major crypto exchanges such as Coinbase Kraken and Binance. This is the safest crypto tax software among the users. Crypto is taxed in the same way as Gold and real estate.

Tax on cryptocurrencies or virtual digital assets announced on Tuesday will create more problems for investors and their tax experts on computing gains and taxation. Koinly tops the list of the best crypto tax software for a good reason. A Bitcoin tax calculator is a tool that helps Bitcoin owners automate the calculator of short-term capital gains tax and the long-term capital gains tax on profit from bitcoins.

How will it impact your crypto income. Just by entering a few basic details on the calculator one can ascertain the short or long-term capital gains tax depending on the holding period. When you sell or trade crypto you have to pay tax on the difference between the selling price and the price you bought it for minus any exchange fees.

Bitcoin Wallet Online Opus Cryptocurrency Schwab Buy Bitcoin Best Way To Invest In Bitcoin Bitcoin Telegram Bi Bitcoin Mining Bitcoin Mining Pool Buy Bitcoin

Crypto Liquidity Protocol Kyberswap Implements New Dwell Worth Charts And Commerce Route Show In 2022 Price Chart Live Price Route

Calculate Bitcoin Taxes For Capital Gains And Income Capital Gain Bitcoin Ways To Earn Money

Koinly Bitcoin Tax Calculator For Canada

Tax Avoidance Or Tax Planning In 2021 Tax Accountant Tax Time How To Plan

Discover Why The Gold Rate In Usa Is Skyrocketing Bitcoin Buy Cryptocurrency Bitcoin Wallet

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship In 2022 Tax Software Best Crypto Personal Journey

Understanding Tax Rules For Rental Property Aol Real Estate Rental Property Investment Real Estate Investing Rental Property Rental Property Management

Zec To Usd Calculator Coin Shop Canadian Dollar Dollar

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Koinly Bitcoin Tax Calculator For Canada

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Koinly Bitcoin Tax Calculator For Canada

Coinbase Is One Of The Biggest Crypto Exchanges For Crypto Trading Budgeting Buy Cryptocurrency Tax Deducted At Source

15 Best Canadian Personal Finance Books You Should Read This Year In 2022 Child Tax Credit Estate Tax Cryptocurrency

It S Been A Tough Week Video Cryptocurrency Trading Cryptocurrency Tough

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income